Financial Independence is rarely achieved by chance

…. for most of us it is preceded by the habits of saving and investing combined with the passing of time.

I am fortunate to never have been in debt (excluding student loans). I paid these off within a few years of starting work and over the rest of my working life have built up cash savings, invested in rental property and peer-to-peer loans, made additional contributions to my pension funds and am now focused on maxing my ISA contributions and aggressively paying down my mortgage.

It happens bit by bit, month by month, slowly and steadily.

Some days, when I’m looking at my spreadsheets, I think I’m in good financial shape and I feel comforted and secure. I feel like I’m winning the FI game. Other days, it just makes me feel old – I traded my time for money and I traded my money for assets and here I am – someone who wishes she was in as good physical shape with maybe a few less grey hairs!

What I’m trying to say is, good habits performed consistently over a long period of time will bring financial success. They just will. End of. And we all age anyway so we might as well make ourselves comfortable for what hopefully will be a long long retirement. This is how we win.

My Financial Blueprint

My approach has been to be frugal within reason and to save and invest as much as I can. We have a comfortable home, definitely not a McMansion, but big enough for the children to have their own rooms and us all not to want to kill each other.

I shop carefully for food, buying mostly store brands, with a few exceptions – I make no apologies for only ever buying Heinz beans and real Nutella 😊. We rarely eat out but we may have a takeaway pizza every few weeks.

I’m an extreme introvert, so in my free time, I like to be at home or out walking the dog and that costs nothing. I drive a 6-year-old Ford Focus which I have no intention of trading in until it dies. I’m not bothered about clothes or shoes or most “things” except books, which I buy cheaply on Kindle.

(I sound fun don’t I……?!!) 😉

As I’ve written about already, my main indulgence is holidays, maybe even a few times a year. In a nutshell, I’m willing to spend on what is important to me and to us as a family, but I’m careful with the rest.

What Do I Do With It Once I’ve Saved It?

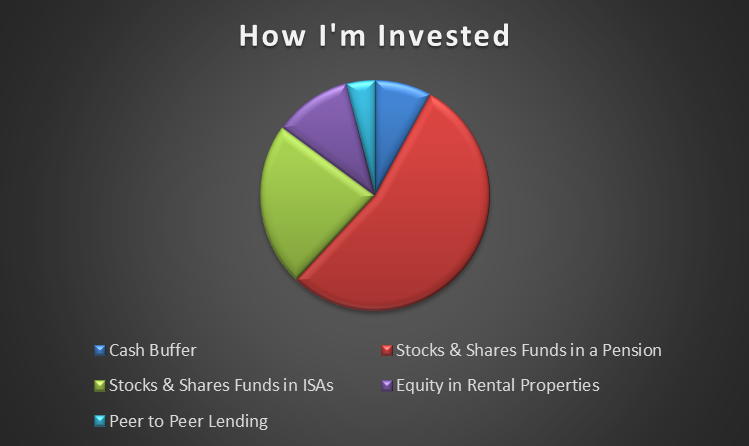

This is what the picture looks like at the moment:

Much of the above has been amassed in the last 5 years when I fell into a role at a fantastic company and have been at my peak earning years. Combine this with no debts to pay down, no setting up home costs, or any of those myriads of things that sap our money when we are starting out and it put me in a powerful position to save.

If I were to look back to even just 5 years ago, I had no rental property or peer-to-peer loans and significantly less in stocks and shares funds and cash. If you are starting out, be patient, it will come.

The funds and Peer to Peer lending are done through on-line platforms. Daunting at first, but I invested a lot of time in reading and research and once over the initial mind-set obstacles, these were straightforward to put in place.

As for the funds – within the platform I am invested in a mixture of active and passive funds. The active funds are a remnant from before I discovered the principles of FIRE. I have sold any that were hideously expensive and moved more and more into low cost index trackers, but I have kept a few of the highly performing active funds because why not? – when they are doing well, it seems counter-intuitive to switch out of them. Thoughts on this approach anyone?

I keep a watching brief on these though and if I feel I am not getting a good enough return to justify the extra charges, I will switch out to my passive index trackers.

Buy, Refurbish, Refinance……Repeat?

I bought my home in 1999 and so I have benefited from many years of positive UK house price growth. In fact, my home is worth more than 3 times what I originally paid for it – something which I did not earn and is purely down to my privilege of being born in this place at this time. Take a cheap (’ish) house and add in the debt eroding effects of inflation and I was fortunate to have been able to pay off my mortgage in my early 40’s.

I enjoyed immensely the feeling of a weight lifted from my shoulders but after a few months I began to think I was wasting an opportunity. So, I partially refinanced my home and used the funds to buy two rental properties in cheaper locations in the North of the country.

Using equity from my home effectively made me a cash buyer and meant I could act quickly and snap up bargains. The properties were seriously distressed and needed complete refurbishment but doing this added heaps of value.

I refinanced one of them, releasing enough cash to purchase a third. I stopped after three which means I have value which is really just sitting dormant in two properties right now. But having created the equity I could repeat this process and buy more rental property. I am not pursuing that at the moment, but it’s something I may come back to in the future to create more cashflow.

(If you are doubting whether you could do the same – let me tell you – I didn’t do this alone. I did the part I’m good at – sitting behind a computer researching and reading and learning. And this led me to a company that did everything else for me – sourced the properties, refurbished them and found tenants. Sure, I paid a fee for this, but would I ever have managed it alone as well as hold down my job and take care of my family? Not in a million years!).

Action Always Beats Inaction

I think it was T. Harv Eker that said “action always beats inaction” and when pursuing financial independence that is so true. FI is not going to land in your lap. You have to invest the time, educate yourself and then act on this knowledge to get your money working for you for the long term. The key to reaching financial independence? Get in the game, focus and be in it to win it.

Join the Discussion

How are you structuring your savings and investments? Are you early in your journey or nearly there? Do you feel like you’re winning?

It looks like you’ve come a long way in just 5 years – well done!

I dipped my toe in Peer to Peer lending a few years back but will have withdrawn all my cash from them in the next year or so. Not for any reason other than to simplify my portfolio and to concentrate on the investments in my ISA. I’m not cancelling any of the loans, just not reinvesting the repayments.

Interesting that you mention that you had a third party source your properties, refurbish and find the tenants – one reason why I only have the one BTL property is that I did it all myself (apart from the finding tenants bit) and whilst I was really chuffed that I did it all alone (I took ‘action’ haha!), the work involved was what put me off from getting another. I know there might be opportunities missed in not using leverage to get another property, but I’ve chosen not to, as it’s not part of my plan.

Do I feel like I’m winning?

I’m not sure really, but I’m heading in the right direction!

LikeLike

Thanks Weenie!

I actually used to have more in peer-to-peer spread across 2 platforms and I’m doing the same as you with one of them, so my % in that will go down overall in time. I think it’s good diversification but don’t want to have too much in there if times get tough with the UK economy and people start to default. That’s not something we’ve seen in the P2P market yet.

Well done for doing the BTL by yourself, that’s a massive pat on the back! I was more involved with the first one so I could learn and I agree – it is a lot of work! So I wasn’t involved at all for the others. Happy to share more about the hands off approach if you change your mind in future.

And from what I’ve read on your site, you’re more than just heading in the right direction – you were one of the people that showed me the way to go 🙂

LikeLiked by 1 person

Ive toyed with the idea of btl but to me a) its too much wealth concentrated in a single asset and b) the recent legislative changes make it less attractive as id have to have a mortgage. I couldn’t afford to buy outright. I do think well be lucky to see house price growth of more than a couple of % a year now. I even toyed with the idea of selling my house and investing the money last year but chickened out. Probably a good job given the current volatility lol

LikeLike

I know what you mean. I had started buying property before I discovered FIRE and I kicked myself for a while that I should have invested more in the market instead as that’s what everyone seems to talk about. But with hindsight, I’m glad I diversified. My plan is that the rental income will form a handy cash-flow when I hit my FIRE number – so if the markets hit a correction, I don’t have to withdraw so much from my investments while they are down and have the sequence of returns risk.

That’s the theory anyway 🙂

LikeLike

Have you u considered doing btl via a p2p site like (i think) property moose or land bay? i just think itd be more diversified than sticking it all in 2 or 3 houses. I am by no means an expert on let property so asking rather than advising!

LikeLike

I looked into it a while ago. But I’m more confident in mainstream property than I am in P2P at the moment. That may change – it’s just that nobody knows how P2P will perform during a recession and I’d like it to be a bit more proven before I go in any deeper. Thanks for the reminder though, I’m not familiar with those sites so I’ll take a look.

The other thing is – the only money of my own sitting in those properties is the equity that was created by buying distressed and refurbishing them. The rest is leveraged. So I don’t feel like I really have much that much tied up in there. And it feels good to have “created” some wealth at the beginning of owning an asset.

LikeLike