I still have some way to go – but it’s fair to say I have saved a good chunk of money into my Financial Independence fund.

At the time of writing this I am 89% of the way there in terms of having enough saved to fund the second stage of my retirement (when I can draw down from my pensions) and I have 78% of the savings I need in place to fund the years until then.

If I succeed in retiring in just under 3 year’s time, I will be 49 years old. It’s not super early like some of the people I read about, but it is well ahead of standard retirement age. I have got to this point partly by having an above average salary in the last few years and partly from good habits or particular personality traits (with a few mistakes thrown into the mix).

These are the habits and traits that have helped me save my financial independence fund.

Always saving into a pension at work and benefiting from the company contributions

With the recent introduction of automatic enrolment, this process is easier than it used to be for many people. Such a thing didn’t exist when I started working but fortunately even in my first job when I earned just £9,500 a year, I did sign up for the pension plan.

I made a couple of mistakes early on though. Twice when leaving jobs I had worked at for less than a year, my contributions were refunded in cash, which I took and promptly spent 😦 . And then for most of my savings years it didn’t occur to me that I could contribute more than the company suggested amounts. Even small additional contributions early on could have made a difference to where I am now, but I wasn’t financially educated back then and it shows.

Contributing to pension savings even in my non-working years

I spent 7 years as a full-time parent and I wouldn’t change that for all the tea in china. My husband had a reasonable salary – by which I mean he earned enough to support that decision and still maintain a good but not excessive standard of living. One holiday a year to Spain type lifestyle. I made sure to open a Stakeholder pension plan as soon as I started my maternity leave and I contributed the maximum allowed by the government. If memory serves me correctly, that would have been around £250 a month, so over the 7 years it added up.

(Mostly) Avoiding Lifestyle Inflation

When the children were in school and I went back to work, I gradually moved from part-time to full-time work and managed to build back my career. My income increased but on the whole, living expenses remained fairly stable. With the exception of our holidays, (which I admit have completely inflated as I move higher up the stress ladder) most things stayed the same. I think I am lucky here in that I just don’t yearn for things the way other people seem to. I don’t care about fashion or cars or expensive restaurants and that has made saving money much easier for me than it is for others.

Paying Myself First

Internet banking and standing orders are wonderful things 🙂 . I get paid on the last day of the month and the following day on the first, a great chunk of my salary disappears into savings and investments. I don’t see that salary long enough to even register that it’s there before it’s put to work somewhere else and we live on what is left.

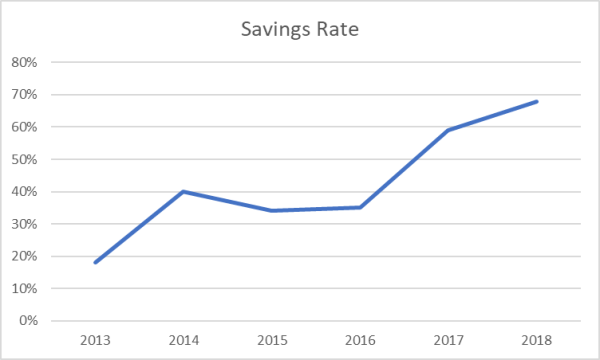

I didn’t always do it this way around and in earlier years I saved what was left at the end of the month. But I’ve noticed a rocket booster under my savings rate since I changed mindset eighteen months ago.

Taking Calculated Risks

To get a higher return usually involves taking higher risk. A few years ago I had paid off my home mortgage and for a while this felt fantastic. I hadn’t yet realised that early retirement was within my grasp but even then, after a time of enjoying the feeling of achievement I started to see that in an environment of historically low interest rates I could get a better return on my money.

After much thinking and researching I took the plunge and remortgaged my home to buy two rental properties in a cheaper part of the country. These were bought cheaply and refurbished and then I refinanced one of them to buy a third.

So now I have three rental properties giving me cash-flow every single month. The total cost of the mortgage interest is £312 and total net rental income is £1,442 per month.

Taking the extra risk of buying these rental house is rewarding me with £1,130 cash-flow per month. To me, that’s not only worth the risk, it has sped up the journey to reaching my financial independence target.

Ignoring Everyone Else

I’m quite good at not caring what other people think; always have been. It’s a personality trait along with introversion and single-mindedness that makes this route easier than it may be for others and for which I’m really grateful.

I feel no pressure to upgrade my car, despite having one of the oldest in the work car-park. I live in jeans – even for work – and completely ignore the latest fashion trends. All of that would exhaust me, never mind severely damage my bank balance.

I stay out of the conversations about how everyone is spending their bonus and instead tune in to my inner voice about what is important to me. And I don’t worry about not ordering the second coffee or the cake when I’m out with friends. If I want one I’ll have one, but my choice is unaffected by what they may think.

Being Security Conscious

Some people seem to sail through life without a care in the world. I’m not one of those. I like to know that I have a roof over my head and that I can afford to keep it there; where the money is coming from and that there is a safety net in place. So building up an emergency fund was a natural thing for me to do, way before I ever discovered FIRE. As was general savings and investments for the “future.” I just didn’t know that future would be sooner than expected. It’s one of those times that being a worrier is a good thing and needing a security blanket works in your favour.

Tracking my finances

Every month I download my bank and credit card statements into Moneydance and analyse my income and expenses. Done regularly, this nips any lifestyle inflation in the bud and really brings home where the money actually goes.

I know I’m strange, but looking at how much I spent on groceries or clothes or fuel this year compared to last really motivates me to do better and cut out wasteful spending.

It also is invaluable in projecting what my expenses will be once I am at FIRE. How else will you really know if you have calculated accurately what your spend is going to be?

I don’t fall into the camp that says it’s not about what we spend on posh coffee or work lunches – it is. My mother taught me to take care of the pennies and the pounds would take care of themselves and I am passing this on to my children. One posh coffee won’t break the bank. One every day is a different story.

Banking Windfalls & Side-hustle Income

A windfall to me does not have to be huge; it is any cash received either unexpectedly or out of the ordinary. In the past I have received money from bonuses at work and share option sales, an insurance payout following a car accident, matched betting profits, eBay sales, earnings from survey sites – every last penny gets funnelled into the appropriate channel and gets to work on my behalf.

Luck and Timing

I can’t dismiss the sheer privilege of being born in this time in this place. The right jobs have come along at the right time and enabled me to improve my earnings. Interest rates being so low for so long have meant I have paid next to nothing for housing costs for the last 10 years. And the incredible growth of the stock market since I have been investing has been nothing short of astounding. These are not things I have had influence over and could claim any credit for, but from which I have benefited hugely and will always be thankful.

(990 Days…)

Join the Discussion

What are the things that have helped or hindered your path to financial independence?

I would say that I’ve had more hindrances on my way to debt freedom/financial independence. The best thing I did for myself was joining the Air Force in 2015, and since then, my life has only moved forward. Unfortunately, now I am 28 and still about $45k in debt. I know that first, I must tackle that before truly making headway.

I do invest up to the match in my retirement plan, but again, I didn’t really start making better financial decisions until I was 25, so I feel very behind. I hope I can get caught up without doing anything too drastic.

LikeLiked by 1 person

Don’t be too hard on yourself liz 28 is nothing you have plenty of time even with the debt. There’s alot of 30 and 40 year old i know in far worse position than you

LikeLiked by 1 person

I agree completely – just being aware and thinking about your finances puts you way ahead Liz, keep at it and things will only get better.

LikeLike

I think you are doing awesome, and I love how you are on the same timetable as me. 🙂

LikeLiked by 1 person

Thanks Ms Zi You – yes, I feel the same 🙂 It’s really comforting to have someone else at a similar stage

LikeLike

The main thing that hindered our path to financial independence is that my wife and I have separate accounts and I never tracked what she spent (and we never fought about finances). Now that she wants to retire early, we are upping the game and I will be tracking everything, hoping my predication of her retiring sooner than later will be true

LikeLiked by 1 person

Well it may have hindered your financial progress but your marriage is intact 😄

Tracking is the key, I,agree, you have to know where it’s going. So I’m sure you will be right and you can help get her there sooner.

LikeLike

Your plan seems far more organised and detailed than my ‘plan’, not that mine is on the back of a fag packet but still in basic spreadsheet form, with years loosely bunched together etc. I have yet to go into detail how I will fund my retirement year by year but I’ll get to it when I’m a couple of years from my goal (she says, waving in a procrastinating way!). By my reckoning, I still need to work full-time for 5 years on at least my current salary and current spending levels before I’m close to/at my goal.

Very impressed that you were contributing to your pension while you weren’t working.

(Sorry, still catching up on my posts and for some reason, not reading your posts in order!)

LikeLiked by 1 person

I think it may be that you are quite relaxed about when you get there whereas I can’t get there quick enough. I envy your attitude really, it’s far healthier than mine 😊

LikeLike

Firstly, it’s so amazing you are up to 89% of your FIRE fund. And secondly, reading this really struck a chord with me. A lot of what you wrote wholeheartedly resonates with me, and although I’m much earlier on my journey, it’s inspiring to read about you making calculated risks to buy up rental properties to increase your monthly cashflow and contributions to your fund. Hopefully one day I will be able to achieve something similar. In the meantime, I’ll be following along keenly. xoxo

LikeLiked by 1 person

Thank you for your kind words, it means a lot to get a comment like this. I’m glad to be helping. And if you are early in your journey and taking the time to read blogs like this, I am sure you will be successful. Good luck!

LikeLike

Have you heard about Mustachian Post’s Blogger Savings Rates Index: https://www.mustachianpost.com/blogger-savings-rates-index/? You should definitely look into joining!

LikeLiked by 1 person

I will look it up! Thanks

LikeLike